August 2, 2025

+4 years in DeFi: What I learned about yield, risk and reality

I've been in crypto since mid-2020 and deep into DeFi since the beginning of 2021. I started building my own portfolio in late 2021, right in the middle of the liquidity mining frenzy on Polygon and Avalanche. Yields became absurd, 30%+ on stablecoins, without even looping. It felt like free money (it wasn't).

It didn't take long to realize that 99% of those tokens would go to zero. So I sold all liquidity mining rewards and I shifted my focus toward stablecoin opportunities, delta-neutral setups, and arbitrage strategies.

Gaining XP and landing my first crypto job

I landed my first crypto job in late 2021 at Swapbox, a decentralized crypto ATM project. I loved the concept, truly different from all the cashgrab projects back then: a serverless, non-custodial ATM directly connected to DEXes, allowing cash-to-crypto swaps without KYC and without financial risk for the operator.

I joined as a UI/UX and brand designer, then transitioned into an analyst role to help the team better understand the DeFi landscape, especially DEX liquidity, stablecoins, and cross-chain markets.

At Swapbox, I designed an internal stablecoin risk framework, helping us classify and evaluate stablecoin exposure across chains.

Later, I met Jonathan Levi in person thanks to Swapbox, and joined Mipasa. I built dashboards and wrote reports on specific DeFi strategies, that I actually implemented myself. One of them tracked a leveraged sDAI position that yielded 20%+ APR for months, with only DAI exposure (more on the strategy later).

Curiosity pays (literally)

Since 2021, I've been managing my own DeFi portfolio consistenly, although I couldn't spend too many hours per week on it. I earned airdrops, not by farming them deliberately, but simply by being curious and testing everything. A few examples: Arbitrum, ZkSync, Maverick, Exactly, Wormhole, Contango, all from just using the tools and being curious about new primitives available onchain.

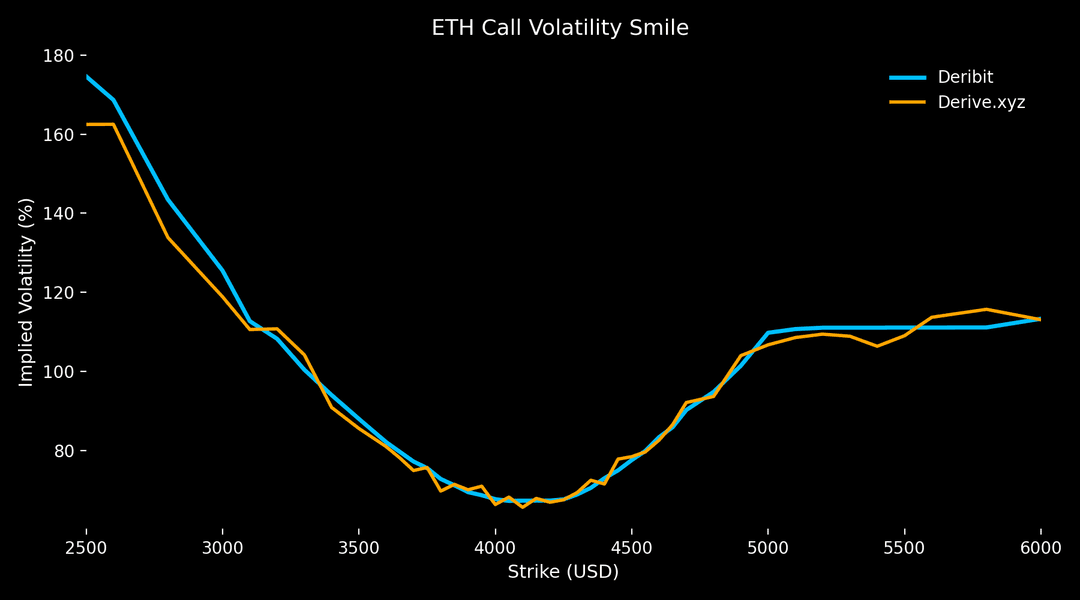

I experimented with option arbitrage between on-chain options and Deribit. I even wrote about it:

10/29/2025

Crypto option arbitrage strategies for all-greek-neutral yielding positions

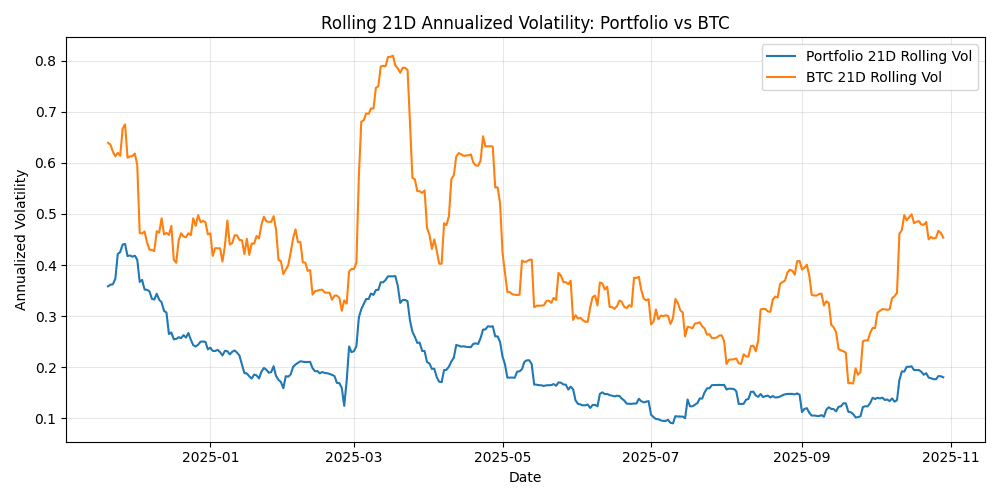

As my portfolio grew, I started thinking more about hedging and protecting upside exposure. That led to another piece I wrote on my strategy to manage risk while keeping exposure:

9/2/2025

How I hedge my crypto portfolio

A few strategy case studies

Contango: fixed vs variable rate loops

One of my favorite experiments was automating an sDAI-DAI looping strategy on Contango. The play was simple: borrow DAI at a variable rate (around 8%) and deposit it into sDAI earning up to 15%. The spread was pure profit. The real challenge was execution. Liquidity on Gnosis Chain is thin, and bridging is painful. My workaround was using Monerium EURE, an off-chain euro stablecoin that let me fund DAI directly on Gnosis 1

, with zero fees. Smoothest funding process I ever had.Maverick: he market-making reality check

I also provided liquidity on Maverick, which looked brilliant on paper. In practice, rebalancing meant realizing impermanent loss constantly. With concentrated liquidity, losses stacked up fast. Even LP automation tools like Arakis or Gamma couldn't make it truly profitable compared to just holding the assets. Lesson learned: market making is a full-time job, not a passive yield strategy.

Morpho Vaults: Plug-and-Play Lending

I experimented with Morpho vaults managed by Ionic. Yields above 10% APY looked solid at first, backed mostly by wETH and cbBTC collateral. But once Morpho's incentives slowed down, yields dropped quickly. A good reminder that incentives ≠ sustainability.

ETH staking yield loops on Contango

In 2024, I used Contango (again, S/O the the team) to leverage my stETH-ETH position with 10x leverage and 0 fees. The APR was actually insane, over 20% for a staked ETH position.

Whales Market: pre-claim airdrop arbitrage

During the airdrop mania, Whales Market emerged, allowing traders to sell allocations before tokens were even claimable. I saw the opportunity right away: short the token before launch, then buy it back post-launch and settle the position on Whales Market. It worked but it was very risky. Illiquidity, volatility, slippage, and skyrocketing gas fees made it risky.

IPOR Protocol: The future of on-chain rates (or not)

Honorable mention to IPOR, which I never actually used. I still think on-chain interest rate swaps are a brilliant idea, but the spreads are just too wide right now to make sense for traders. As lending markets mature and stablecoin rates stabilize, I expect better rate-swap pricing to emerge.

Exactly Protocol: 30%+ Stablecoin Yields

At one point, Exactly Protocol offered over 30% APY on USDC thanks to their Optimism liquidity mining season. I took the opportunity, farmed the yield, and yes, sold the airdrop immediately. Sorry guys.

Most of the time

This was my more exotic use of DeFi. Most of the time, though, I stick to the big and boring stuff: holding, parking funds in Aave or just holding LSTs.

Non exhaustive list of tools I use

I just finished writing this article, but I realized I didn't even mention the tools I use to find opportunities, monitor risk or investigate a strategy, so here is a non exhaustive list.

Analytics & strategy

- DefiLlama for protocol data

- Dune Analytics for monitoring precise protocol and onchain data

- Coingecko API, for fetching prices

- Python, NumPy, Pandas and Matplotlib, for manipulate data and tracking

- Nansen, for analysing flows and big actors

Execution & Portfolio management

- Rabby wallet, to reduce the risk to get scammed

- DefiLlama Swap for the best onchain swap rates

- Kraken, as my main CEX. Neat UI, useful tools, low fees

- Revoke.cash, for revoking approvals

Lesson learned

- Curiosity pays.

- Monitoring is essential.

- Liquidity, slippage and spreads matter.

- High yield get arbed quickly.