September 2, 2025

How I hedge my crypto portfolio

My crypto portfolio is composed of 85% BTC and ETH, and 15% DeFi positions. Since my BTC and ETH holdings have appreciated significantly since I began DCA'ing into them, I wanted to de-risk my portfolio without selling my assets.

I had several options, but each came with trade-offs. Using options requires paying a premium, while using futures essentially replicates the payoff of selling the assets.

So, I chose a different approach with a risk profile that I believe is much more favorable. Since 99.99% of tokens are destined to go to zero (that's a fact, not an opinion), I decided to short a basket of altcoins against BTC. I don't want exposure to the overall market direction; I want exposure to these altcoins relative to the market. I'm confident that the coins I selected will underperform, and the past six months since I started the strategy have confirmed this view.

How I Select the Coins

- The narrative has already died (e.g., alt layer-1s, NFT collection tokens)

- The hype cycle is over (was strong in 2020-2022)

- High market capitalization (e.g., POL, DOT, ICP)

- Marketing budgets largely exhausted

- TVL consistently decreasing

- No real user adoption

- Better alternatives exist

- And of course, I pick the coins with the most negative beta.

How I allocate the capital

Some coins cannot be shorted directly against BTC. In that case, you need two positions: one short on the altcoin and one long on BTC. How do you determine the size of the short relative to the BTC long?

Since we're targeting coins with asymmetric beta, we separate beta into its positive and negative components and focus on the negative one. Our ideal altcoin will typically have:

The negative beta is calculated as follows:

where:

- = return of the altcoin

- = return of Bitcoin

Once we have calculated the negative beta, we can determine the hedge ratio relative to the BTC spot position:

where represents the USD notional ratio of the altcoin short to the BTC long.

Where to implement

- On mature exchanges, you pay higher funding rates but reduce counterparty risk.

- On newer “degen” perpetual exchanges (Aster, Hyperliquid, etc.), you might even earn funding, but you take on higher counterparty risk.

Since this is primarily a hedge, I prefer to pay a bit more and use established exchanges to minimize counterparty exposure.

And the results ?

I implemented this strategy gradually starting in May 2025. I built a basket of five altcoins for which I had a strong bearish view, based on the criteria above: POL, DOT, APE, EGLD, and XTZ.

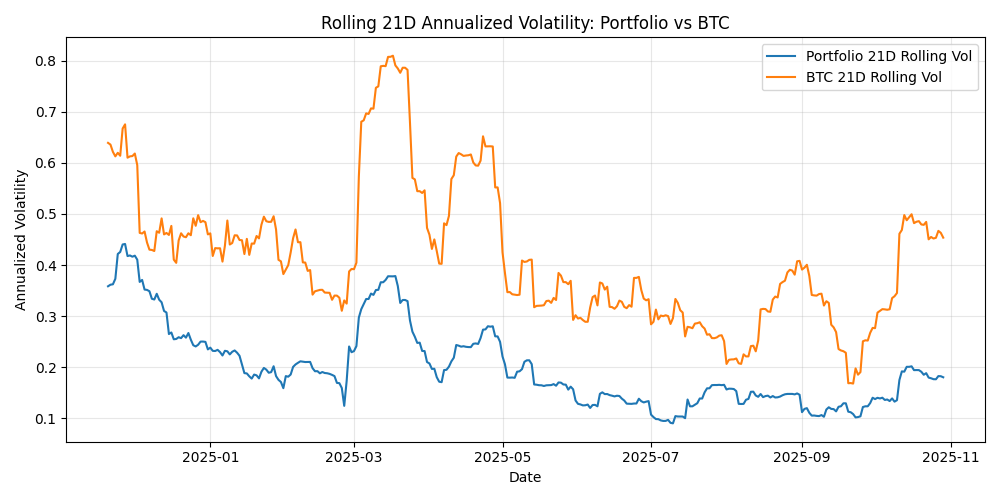

The results have exceeded expectations. The volatility of the combined (BTC + hedge) position is lower than anticipated, while the downside pressure on altcoins has been stronger than expected.

The chart below illustrates how the volatility of the hedged position is significantly lower than that of a pure BTC long.

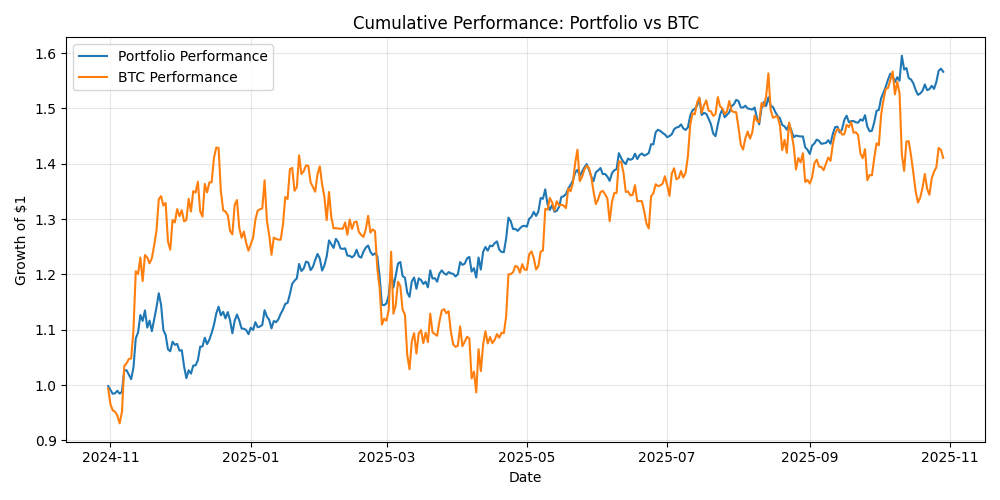

Below is the performance of the overall position, including the BTC spot long. For simplicity, it assumes a static negative funding rate of 10% APR for all altcoins, which corresponds to the six-month average.

The performance slightly exceeds that of a pure BTC long, but with much smoother returns and smaller drawdowns.

Going forwards

I could have made the allocation calculation more dynamic, or used a more precise formula, sure. But that would not have improved the quality of the hedge in any meaningful way. What really matters is which altcoins I chose and why, because that is where most of the hedge's performance actually comes from.

I also did not expect the risk profile to be this attractive. As a result, I am now considering treating this strategy as a standalone position in my portfolio, not just a hedge. That is why I will keep researching coins with similar downside potential and gradually increase the position size within my overall allocation.